Discover how Market Matters delivered a

15.3%* return in their

Income Portfolio

MARKET PULSE CHECK

How will reporting season impact our portfolio positions?

Take your income investment strategies to the next level.

DOWNLOAD YOUR FREE REPORT

Last Financial Year, Market Matters Active Income Portfolio delivered a +15.36%* return, striving for sustainable income with significantly less volatility than the market.

In this free report — we break down "the good, the bad & the ugly”, reviewing the standout income stars, as well as analysing our underachievers.

Get an inside look at our key investments and understand our strategies around nurturing winners and managing laggards. The report will also cover detailed insights into our approach for trimming, holding, or even doubling down.

As investors continue to look for strong income performance, in a turbulent market, this is a free report not-to-be missed.

ABOUT MARKET MATTERS

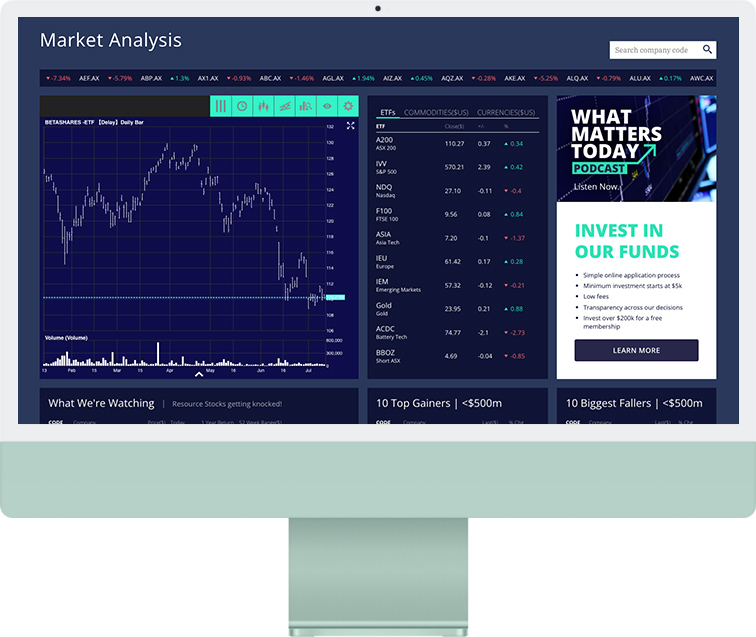

Market Matters combines premium features and functionality, with an institutional-level of data, analysis and commentary to deliver a service like no other.

Whether it's their high-performing portfolios, dynamic company pages, daily reports or succinct actions — Market Matters gives investors the tools and the know-how to quickly make smarter, more informed investment decisions.

With an active approach, Market Matters prides itself on transparency, accountability and performance. They’re confident in their wins and open in their losses; a sentiment their members deeply appreciate.

Members also gain access to some of Australia’s most prestigious money managers, with real money in the markets and crucially — Market Matters own portfolios.

Put simply, Market Matters levels the playing field to deliver the ultimate investor experience.

WHAT MEMBERS SAY ABOUT MARKET MATTERS

"I really appreciate your global view of the markets and then also the micro view on individual stocks. The buy/sell notices are great and your thoughts about how this very tricky market might/or might not evolve have been considered and mostly very correct!"

*Active Income Portfolio FY 23 of 15.36% achieved between 01/07/22 to 30/06/23.